Everything to Know About LCFS & CARB’s Zero Emission Forklifts Regulations

Here are answers to some common questions about the new Zero-Emission Vehicle Program, CARB initiatives, mandates, regulations, and LCFS (Low Carbon Fuel Standard) program.

What is the California’s Zero Emission Forklift Rule?

The California Air Resources Board (CARB) initiatives and mandates aim to phase out the sales of all new gas-powered forklifts in the state by the end of 2026. CARB is looking to decrease forklift emissions and shift to zero-emission technologies to meet air quality goals while reducing air pollution and greenhouse gases.

To increase the deployment of zero-emission forklifts, this rule is phasing out the usage of propane forklifts in California and requiring the use of zero-emission engines (such as electric) instead.

With around 100,000 forklifts operating statewide, this initiative targets sectors like manufacturing and freight facilities, including warehouses, distribution centers, and ports.

Why the Zero Emission Initiative is Needed to Lower Forklift Emissions?

California suffers from the nation’s most severe air quality issues. Specific challenges are observed in regions like the San Joaquin Valley and South Coast. Further emissions reductions are imperative to achieve air quality goals by 2031 and 2037. Off-road equipment plays a significant role in contributing to emissions.

When does the proposed ban take effect?

CARB plans to ban sales of all new forklifts that are not zero-emission by 2026. These include gas-powered forklifts.

What does the CARB’s Zero Emission Forklifts Regulation mean for my business?

Starting in 2026, businesses cannot purchase or lease new internal combustion (IC) engine forklifts.

They must also phase out and retire IC forklifts that are 13 years or older.

Are all forklifts affected by the planned regulation?

No. The regulation applies to IC forklifts with a lift capacity of 12,000 pounds or less.

CARB’s mandate does not affect rough-terrain forklifts, pallet jacks, military vehicles, forklifts with telescoping booms, and those used at ports or rail yards.

Are there exemptions or allowances for businesses to use IC forklifts?

Yes. Businesses can rent IC forklifts for up to 30 days per year for unexpected needs.

There’s also a low-use exemption for fleets using IC forklifts less than 200 hours per year.

Is there a limit on the number of low-use forklifts allowed?

Yes. Businesses can have up to 10% of their total fleet as low-use IC forklifts.

Are there exemptions to the CARB Zero Emission Vehicle Program for small businesses?

Yes. Small businesses with fewer than 25 employees and less than $5 million in annual revenue can keep one low-use IC forklift indefinitely.

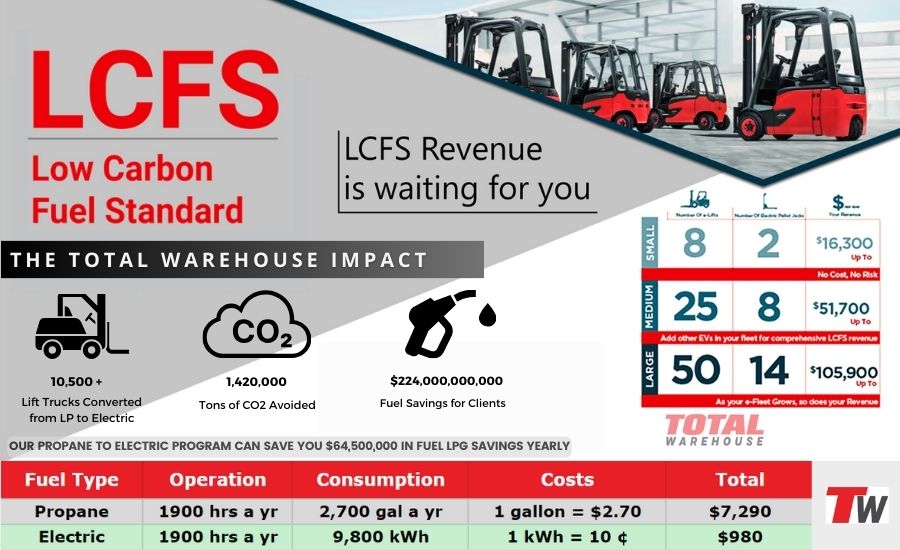

Cash Incentives for Electrification & Lowering Carbon Intensity Score

When you operate forklifts using cleaner fuels that produce less carbon than traditional diesel or propane, you can earn money through CARB”s Low Carbon Fuel Standard (LCFS) program for zero-emission electric equipment owners. Here’s how it works for your forklift fleet:

Each clean forklift creates financial value. When your forklifts run on alternative fuels that have lower carbon intensity (CI) than the government’s benchmark, they generate credits that can be sold for profit.

The cleaner your fuel, the more money you make. Electric forklifts are especially valuable because electricity typically has a negative carbon score in these programs, meaning electric forklifts generate more credits than other alternative fuels.

LCFS credits are available every quarter to individuals leasing or owning chargers for electric lift trucks, EVs, and heavy duty vehicles. Credits are determined based on charger efficiency, battery size, and fleet usage data that quantify the CO2 emissions saved by adopting low carbon fuel alternatives.

For warehouse and distribution center operators, switching your forklift fleet from propane or diesel to electric, biodiesel, or hydrogen can create a new revenue stream while reducing emissions.

In some states like Oregon, only certain businesses can collect these credits directly. For example, if you own electric charging stations for your forklifts, you may qualify to receive rebates, while individual forklift owners might not.

Convert your forklifts to electric to generate credits for max savings with big rebates, while contributing to a greener, sustainable future.

This standard currently applies to California, Oregon, and Washington.

How LCFS Credits Are Bought and Sold: A Market-Based System

When transportation fuel providers exceed carbon limits, they must purchase credits to balance their environmental impact. Here’s how this market works:

The buyers of LCFS credits include oil companies, fuel refineries, importers, and wholesale distributors who cannot meet increasingly strict carbon intensity (CI) requirements. These companies face financial penalties if they don’t offset their excess emissions by purchasing credits from cleaner fuel providers.

Credit values are determined through a dynamic market mechanism based on:

- Total deficit volume needing offset across all high-carbon fuel providers

- Available supply of credits generated by low-carbon fuel providers

- Annual tightening of CI benchmarks, which steadily increases credit demand

The LCFS market experiences significant price volatility, with credit values sometimes changing dramatically within hours. This instability explains why most transactions occur in large batches – fuel producers prefer to make fewer, larger purchases to minimize their exposure to rapid price swings.

Unlike fixed carbon taxes, this trading system creates a self-adjusting marketplace where environmental compliance costs reflect real-time economic conditions. For clean fuel providers, understanding market timing can significantly impact revenue potential when selling accumulated credits.

As CI benchmarks continue becoming more stringent each year according to program schedules, the structural demand for credits typically increases, creating long-term value despite short-term fluctuations.

Analysis of LCFS Credit Prices

The California Low Carbon Fuel Standard (LCFS) credit market has experienced a significant price decline since 2021, dropping from the maximum allowable $200/t CO₂e to approximately $60/t CO₂e currently. This phenomenon merits examination both for understanding California’s market dynamics and for predicting similar trends in Canadian markets.

Several interrelated factors are driving this price depreciation. The LCFS credit price traditionally reflects the cost differential between conventional diesel and renewable diesel, with the credit price bridging this gap to incentivize adoption of lower-carbon alternatives. However, this differential has been shrinking due to:

- Complementary federal policies like the Renewable Fuel Standard and various production subsidies

- California’s emissions cap increases, which elevate fossil fuel costs relative to low-carbon alternatives

- Zero-emission vehicle mandates generating an influx of electricity-based credits

The fundamental market imbalance—where credit generation consistently exceeds demand—has resulted in a substantial surplus of approximately 29.19 million unused credits. The California Air Resources Board (CARB) projections indicated this imbalance would worsen after 2030 without intervention, primarily due to electricity credits flooding the market as zero-emission vehicle adoption accelerates.

In response, CARB has approved amendments to the LCFS, strengthening the carbon intensity reduction requirements from 20% to 30% by 2030, with continued tightening to 90% by 2045. These adjustments aim to stabilize credit prices between $100-$200.

What paperwork is involved to stay compliant?

Businesses must submit initial and final reports to CARB with company and forklift information.

Total Warehouse handles the administrative burden of the LCFS application at ZERO cost to you.

How can Total Warehouse Help?

As the Total Specialist, we handle the end-to-end LCFS process from the complex aspects of regulatory compliance to reporting and transactions.

For more answers and guidance on CARB’s Zero Emission Forklift Mandate, schedule a free consultation with our Total Warehouse material handling experts.

Contact our specialists for an evaluation of your potential LCFS revenue and fuel savings.

Learn How Total Warehouse Can Help: CARB’s LCFS Program

Learn More About LCFS: Empowering Businesses with LCFS Program and Credits

At Total Warehouse, we can ensure that the process of going electric and participating in the LCFS program is extremely easy. Our experts provide comprehensive LCFS credit management and have helped countless businesses across the United States achieve lower maintenance, reduced costs, increased worker satisfaction, and increased economic sustainability by making the switch. Our team of highly knowledgeable experts can help you make the right decision for your business. Give us a call at 833-868-2500 or contact us online.